The costs of Viking Bold: Tuition rises as debt limits financial flexibility

On Nov. 3, Augustana students received an email from Chief Financial Officer Shannan Nelson announcing that the Board of Trustees approved a 3.27% increase in undergraduate tuition and fees for the 2026–27 academic year. The announcement follows a reported $2.6 million deficit for fiscal year 2024 — Augustana’s first deficit since 2009.

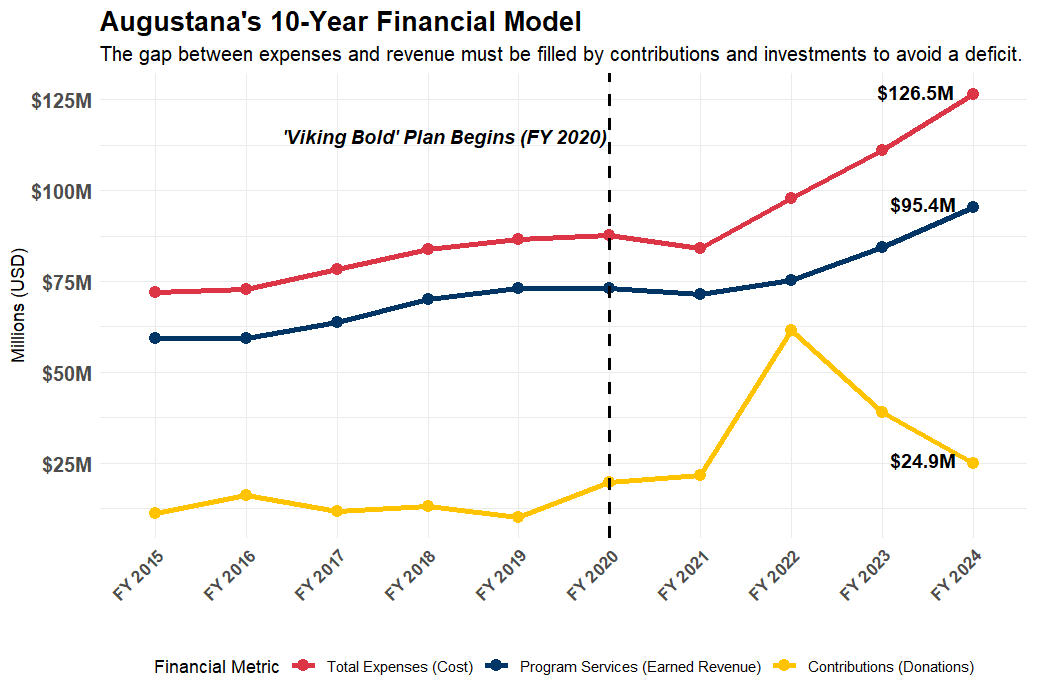

A decade of the university’s public Form 990 tax filings shows a financial model in which expenses have outpaced tuition-driven revenue, with the difference covered largely by contributions.

Over the past decade, Augustana’s total expenses have remained higher than the revenue generated through core programs like tuition and student services. This pattern is common: A March 2025 Cambridge Associates study of 90 private colleges found that, before endowment spending and donations are considered, the average private university operates with a -15.3% deficit.

At Augustana, the gap between expenses and program revenue widened following the launch of the Viking Bold strategic plan in 2020, which introduced several major capital projects such as Wagoner Hall and the Midco Arena.

In 2022, fundraising increased significantly to a record $61.4 million in contributions. That total included major one-time gifts tied to construction projects like the Midco Arena. These donations were enough to offset rising costs and keep the university in surplus even as expenses rose.

However, as fundraising returned to more typical levels — $24.9 million in 2024 — expenses continued to climb. Expenses reached $126.5 million in 2024, up from $87.6 million in 2020. With contributions no longer large enough to bridge the gap, Augustana recorded a $2.6 million deficit, its first deficit in 15 years.

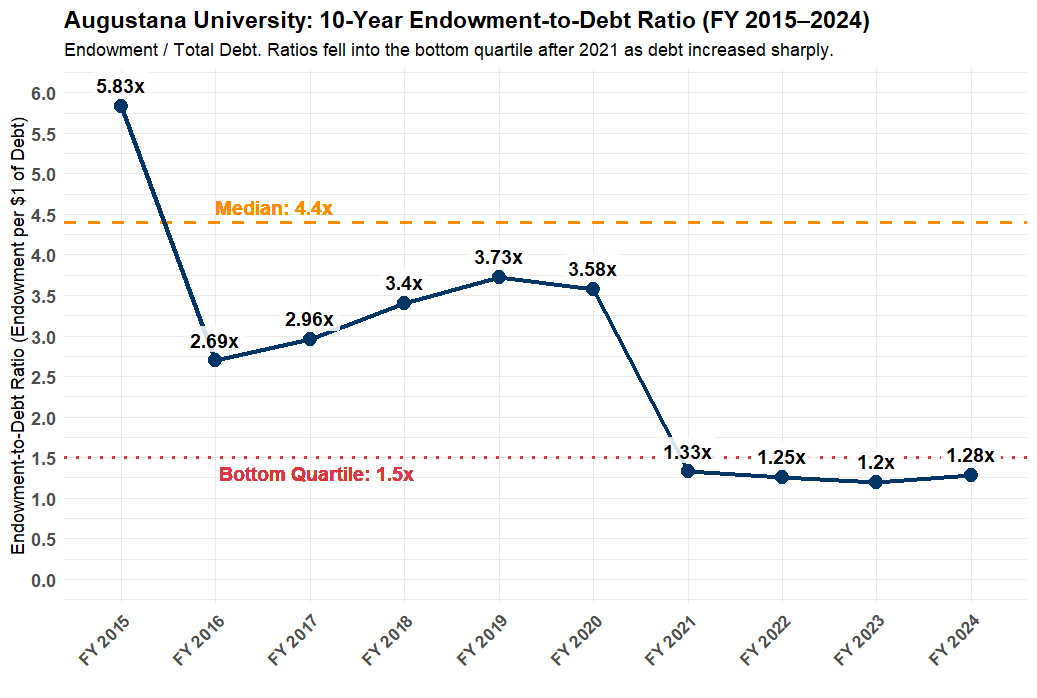

Cambridge Associates’ recent endowment study explains why the financial risk of a deficit varies widely by institution. One of the report’s main measures is the endowment-to-debt ratio, which indicates a university’s long-term financial ability to absorb shocks, invest in growth or withstand enrollment declines. The study found a median ratio of 4.4x among private colleges, with institutions below 1.5x showing significantly less flexibility.

Debt is not reported as a single figure on Form 990s, but it can be calculated using three specific lines in Part X, the balance sheet section. Augustana’s total debt was calculated by adding line 20: tax-exempt bond liabilities, which reflects outstanding bonds issued for capital projects; line 23: secured mortgages, long-term loans; and line 24: unsecured loans to unrelated third parties.

These lines represent the university’s long-term borrowing obligations — the liabilities that function as true institutional debt. This is different from total liabilities, which include a range of non-debt obligations such as accounts payable, accrued expenses, and grants payable. Endowment values, by contrast, are directly reported.

Over the past decade, Augustana’s endowment grew steadily, rising from $71.7 million in 2015 to $126.5 million in 2024. But the university’s debt rose much faster — from $12.3 million in 2015 to $98.9 million in 2024 — reducing its endowment-to-debt ratio.

In 2015, Augustana had $5.83 in endowment for every dollar of debt. By 2019, the ratio remained above 3x. But as debt increased to finance construction tied to Viking Bold, the ratio fell below Cambridge Associates’ 1.5x “bottom quartile” threshold. It has remained near that level for the past four years, reaching 1.28x in 2024.

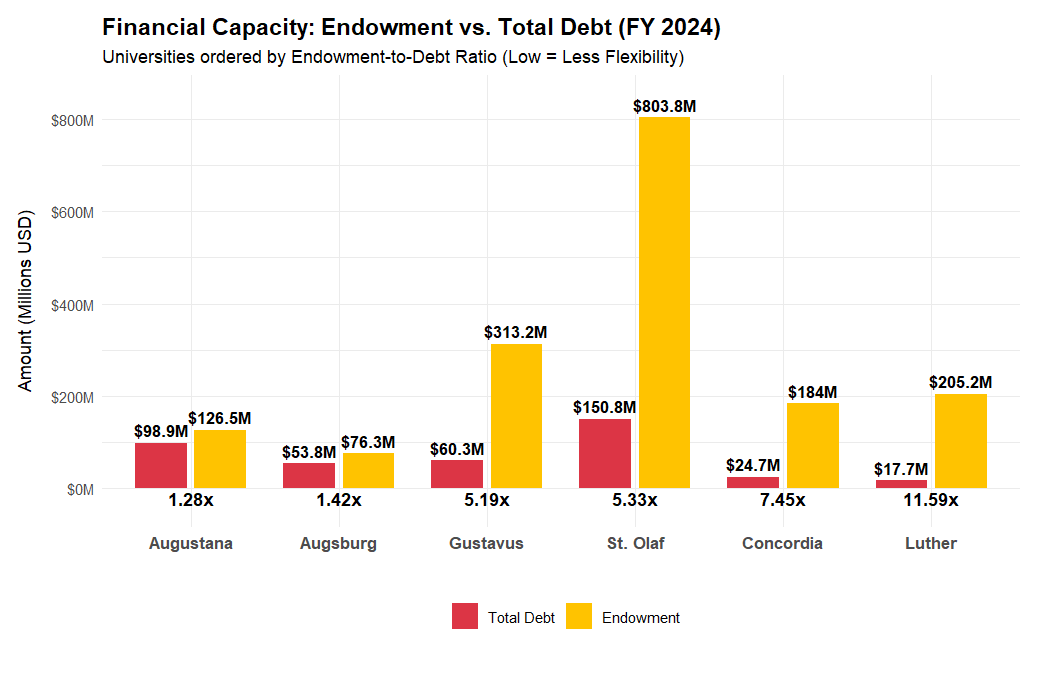

Compared to other private liberal arts colleges in the region, Augustana now operates with one of the lowest endowment cushions relative to its debt.

In 2024, Augustana’s ratio was 1.28x. Augsburg’s was slightly higher at 1.42x. But other nearby institutions show far stronger balance sheets: Gustavus Adolphus stood at 5.19x, Concordia at 7.45x and Luther at 11.59x. St. Olaf — with an $803.8 million endowment — recorded a ratio of 5.33x.

These differences affect how well universities can absorb deficits. Institutions with higher ratios are better positioned to sustain periods of lower revenue or rising expenses without bein pressured to pass the cost directly to students through tuition increases.

For Augustana, a lower ratio means less flexibility. Without a large endowment cushion, the university relies more heavily on annual donor generosity and sustained tuition revenue to maintain operations.

Nelson’s Nov. 3 email made the university’s financial pressures clear. In addition to announcing the tuition increase, he encouraged students to write thank-you notes to scholarship donors, describing their participation as “essential” to expanding financial aid for future students. Nelson did not respond to the Mirror’s requests for comment.

Halfway through its ‘Journey to 2030,’ Augustana’s Viking Bold plan has delivered new and updated facilities, but the university’s financial picture reveals it has done so by trading its long-term financial flexibility for a significant burden of new debt that will shape its finances for years.